Sweet Insights

2023 State

of Treating

Supply chain disruption, 40-year high inflation and lingering COVID-19 concerns continued to affect confectionery shopping and consumption patterns. What did not change was the nation’s love for confectionery. Americans continued to treat themselves and others during seasonal and everyday occasions. Confectionery set new dollar sales records in 2022 — with gains far ahead of most other categories in the store. To maintain this strong momentum, NCA’s 2023 State of Treating report aims to bring a deep understanding of the confectionery consumer and market drivers to get a read on future patterns and demand.

2022 Category Sales Performance

In all channels, both measured and unmeasured, confectionery sales were as follows:

$23.9B

Chocolate

Total Sales

+

$15.4B

Non-Chocolate

Total Sales

+

$3.2B

Gum & Mints

Total Sales

=

$42.6B

Confectionery

Total Sales

Source: Euromonitor Projections as of December 2022

In IRI-measured channels only, growth for each segment was as follows:

9.1%

Chocolate

2022 Dollar Sales Growth

13.8%

Non-Chocolate

2022 Dollar Sales Growth

13.8%

Gum & Mints

2022 Dollar Sales Growth

Source: IRI, MULO+C, 52 weeks ending 1/1/2023

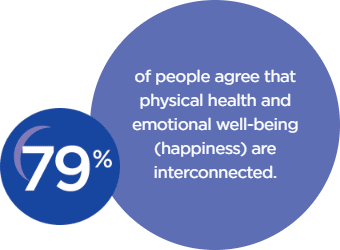

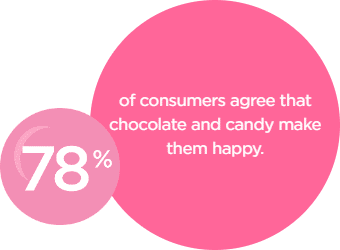

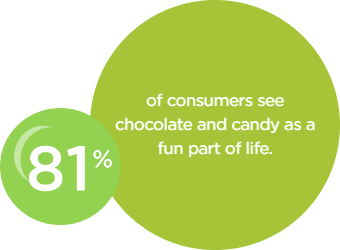

Category Permissibility

Candy sales grew in 2022 despite economic pressures by being…

- An affordable treat

- A beloved treat that makes people happy

- Highly permissible in a balanced lifestyle

Brands offering portion size variety is of growing importance, according to candy shoppers.

69%

2021

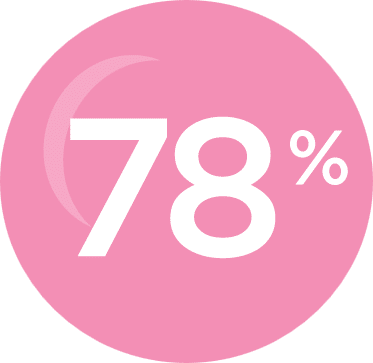

78%

2023

NCA | State of Treating 2023

Confectionery Purchases & Innovation

Consumers typically buy confectionery in three to four different channels, led by supercenters and supermarkets.

Supercenters

Supermarkets

Value Stores

Drug Stores

Club Stores

Convenience Stores

61 percent of shoppers occasionally or frequently look for confectionery products they have never purchased before.

Connecting With Consumers

Social Media

of active social media users have searched for confectionery-related content

Top Candy Searches:

Gifting Ideas

Baking with Chocolate/Candy

Serving/Presentation

Ideas

Crafting with Candy

Environmental, Social and Governance Efforts

Transparency is the currency of trust.

Top 5 preferred ways of learning about a brand’s ESG practices:

Package Label

Brand’s Website

Social Media

In-Store Signage

Store’s Website

Produced by:

|

|

Made financially possible by:

Sales data provided by:

Study Methodology

Shopper insights were collected using an online survey conducted in December 2022 among a national sample of 1,567 consumers between the ages of 18 and 75. The survey findings are overlaid with IRI retail measurement and household panel data. Future market predictions are provided by Euromonitor. The study was conducted by 210 Analytics, LLC. Unless otherwise attributed, data throughout this report are provided by NCA and 210 Analytics.